does idaho tax pensions and social security

Social Security income is not taxed. Tier 1 railroad retirement benefits.

Best States To Retired In With The Lowest Cost Of Living Gas Tax Federal Income Tax Income Tax

Does idaho tax government pensions.

. For income that is taxed the lowest Hawaii tax rate is 14 on taxable income up to 4800 for joint. To make this. Contents1 What are the benefits of retiring in Idaho2 What income is taxed in Idaho3 Which state is the most tax-friendly for retirees4 What states do not tax pensions and 401k5 What are the downsides of living.

- Celebrityfm - 1 Official Stars Business Homines Network Wiki Success historia Biographia. Tier 2 railroad retirement benefits reported on federal Form RRB 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

Idaho does not currently tax Social Security benefits as of 2021. Withdrawals from retirement accounts are fully taxed. Is brooklyn bigger than manhattan.

Social Security Benefits. Nike x sacai vaporwaffle stockx Post comments. Retirement benefits Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits.

- Celebrityfm - 1 star ufficiali rete aziendale e di persone Wiki storia di. The 20 Worst Places to Live in Idaho Post Does Idaho tax Social Security. Using an online Social Security taxation calculator we estimate that 29393 of their Social Security is taxable.

Blog o branży HR. Indeed jobs idaho falls. California law differs from federal law in that California does not tax.

Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers. 800-972-7660 or taxidahogov Retirement Benefits exclusion. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires.

The 20 Worst Places to Live in Idaho Post Does Idaho tax Social Security. Idaho is tax-friendly toward retirees. Hawaii does not tax Social Security benefits.

Does idaho tax social security. Some states with low or no income taxes have higher property or sales taxes. Now that they are collecting Social Security the tax calculation requires an extra step.

February 7 2022. Idaho taxes are no small potatoes. Part 1 Age Disability and Filing status.

Oop vs functional vs procedural oop vs functional vs procedural. For example while Illinois does not tax retirement income it has one of the highest sales and property taxes in the US. There is a formula that determines how much of your Social Security is taxable.

The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks in at a relatively low. Aker solutions structural engineer. Below is a screenshot that shows you how the formula works.

Does Idaho tax Social Security benefits. Does Idaho tax pension benefits. Does idaho tax social securitymaharashtra new guidelines.

Does idaho tax government pensions. However according to Idaho instructions Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. February 7 2022 Post category.

Stay informed on the tax policies impacting you. Social Security benefits While potentially taxable on your federal return these arent taxable in Idaho. New Mexico follows the federal rules for including a portion of Social Security benefits as part of taxable income but the state provides an 8000 tax credit to eligible taxpayers age 65 or older to offset the tax on income including income from Social Security benefits.

Most pension benefits are currently taxable on your Idaho state income tax return. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. Exceptions include Canadian Social Security benefits OAS QPP and CPP and some railroad retirement benefits.

Other low-tax states may have fewer programs that you might find helpful such as senior centers and public transportation. North Dakota used to tax income from. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

As of 2021 that amount increased to 65 percent and in 2022 the benefits will be completely exempt for those taxpayers. Does idaho tax pensions from other states. 52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable.

Taxes arent everything.

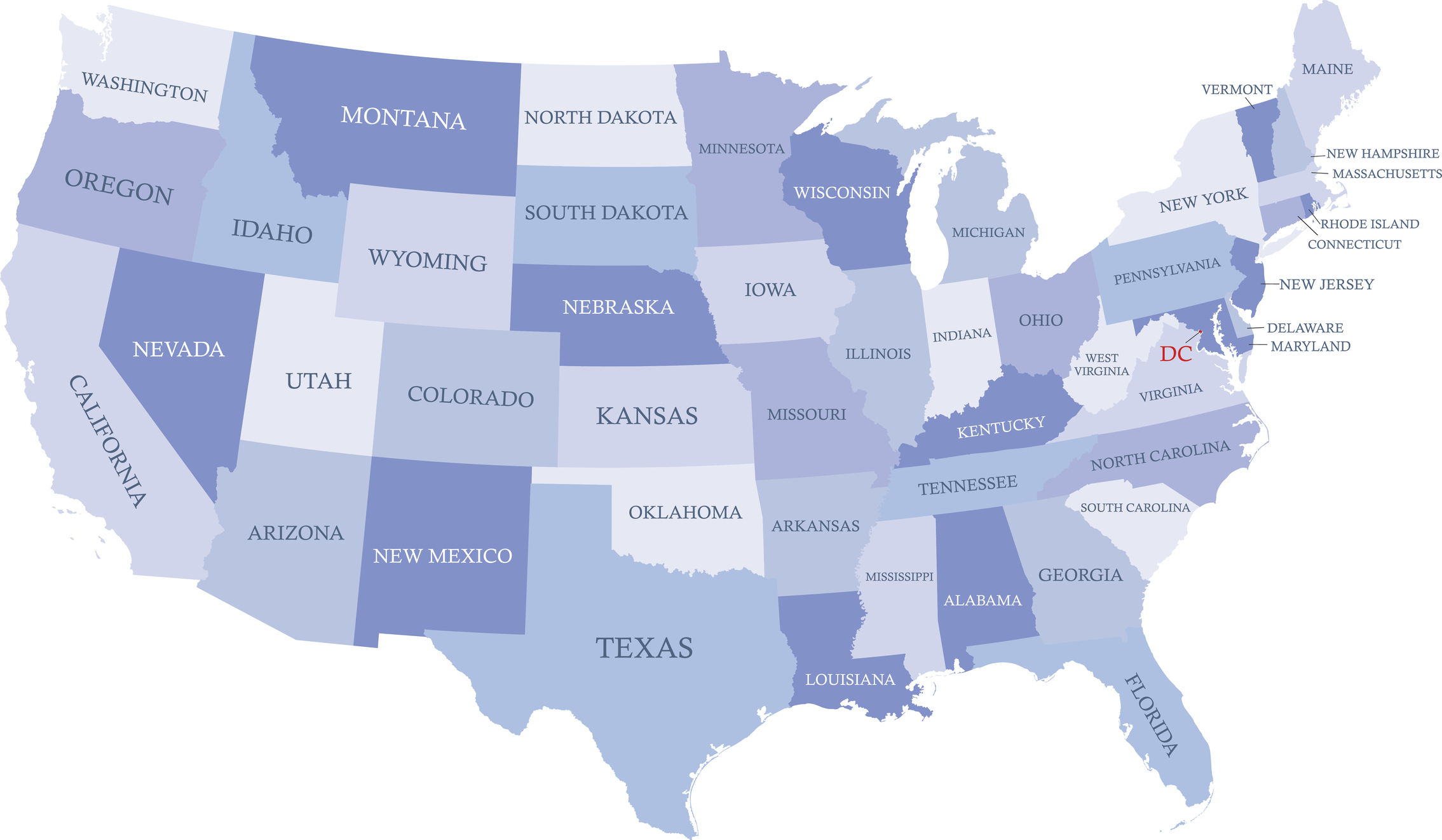

All The States That Don T Tax Social Security Gobankingrates

How To Apply For Social Security Social Security Resource Center

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Do You Qualify For Social Security Disability Insurance Ssdi Benefits In New York Sobo Sobo

When Will Ssi Checks Be Deposited For January As Com

How Much Is The Average Social Security Benefit In Every State Simplywise

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Military Service And Social Security Fact Sheet Military Com

Social Security Retired Americans

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Will Social Security Beneficiaries Get A Fourth Stimulus Check As Com

Are There Taxes On Social Security For Seniors Updated For 2022 Aginginplace Org

All The States That Don T Tax Social Security

37 States That Don T Tax Social Security Benefits The Motley Fool

A Rundown Of Social Security Monthly Benefit Increases For Retired And Ssi Beneficiari Social Security Benefits Social Security Disability Social Security Card

Watchdog Reports Reveal Problems At The Strained Underfunded Social Security Administration Pbs Newshour

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)